TTHS SD205 has saved south suburban taxpayers nearly $35 million through abatements, official says

Since 2018, the district has saved property owners millions since its applied for and secured tax abatements through the Illinois State Board of Education.

A consistent effort to provide financial relief to south suburban property owners has resulted in millions in abatements, thanks to help from Illinois.

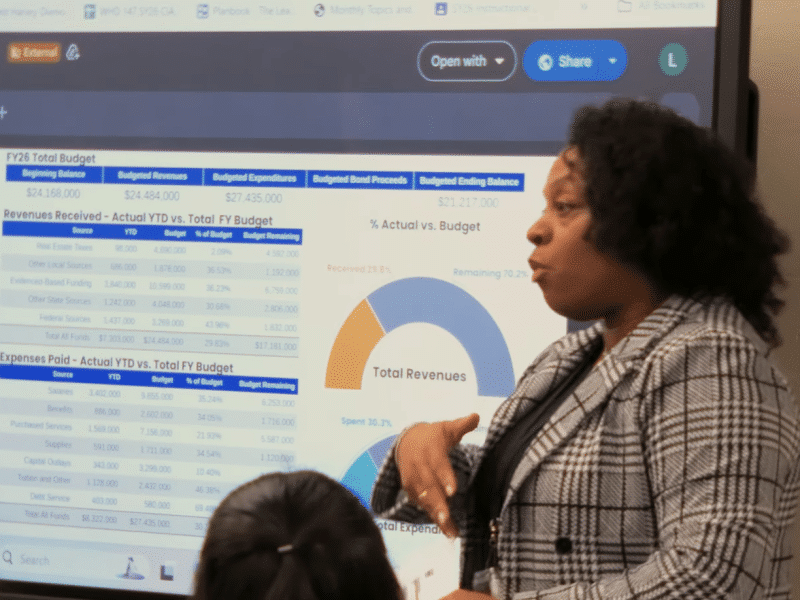

Real estate taxes account for 43 percent of district revenue share, Thornton Township High Schools District 205 Assistant Superintendent of Business Operations Toriano Horton said during his board presentation on Nov. 13.

Thornton Township High Schools District 205’s 2024 tax levy will generate nearly $90 million in revenue for the district, he projected, with a set tax rate limit of 3.4 percent. Those dollars support matters like operations and maintenance, the working cash fund, and transportation funds.

According to county data, the south suburbs pay some of the highest real estate property taxes in all of Cook County. Since 2018, Illinois State Board of Education has offered property tax relief grants, wherein it pays a district to reduce its levy such that the total amount charged to taxpayers is reduced by that very amount.

The district has saved taxpayers nearly $35 million, according to Horton’s presentation, in the years since it began applying for and securing abatements. For the 2024 fiscal year, state property tax relief abatements will generate $6.84 million in savings for taxpayers.

Beginning with the 2024 school year, Illinois requires districts to monitor and publicly share its fund balances; it’s to ensure officials aren’t simply sitting on large quantities of dollars and to ensure educational spending.

If cash reserve balances are” 2.5 times,” or 250 percent, greater than the average of its operational expenditures for the prior three fiscal years, a school district is required to submit a reduction plan to ISBE, according to state law. “The average operations fund balance over the last three years is only 66.45 percent,” Horton said, “well below the 250 percent threshold required by state regulations.”

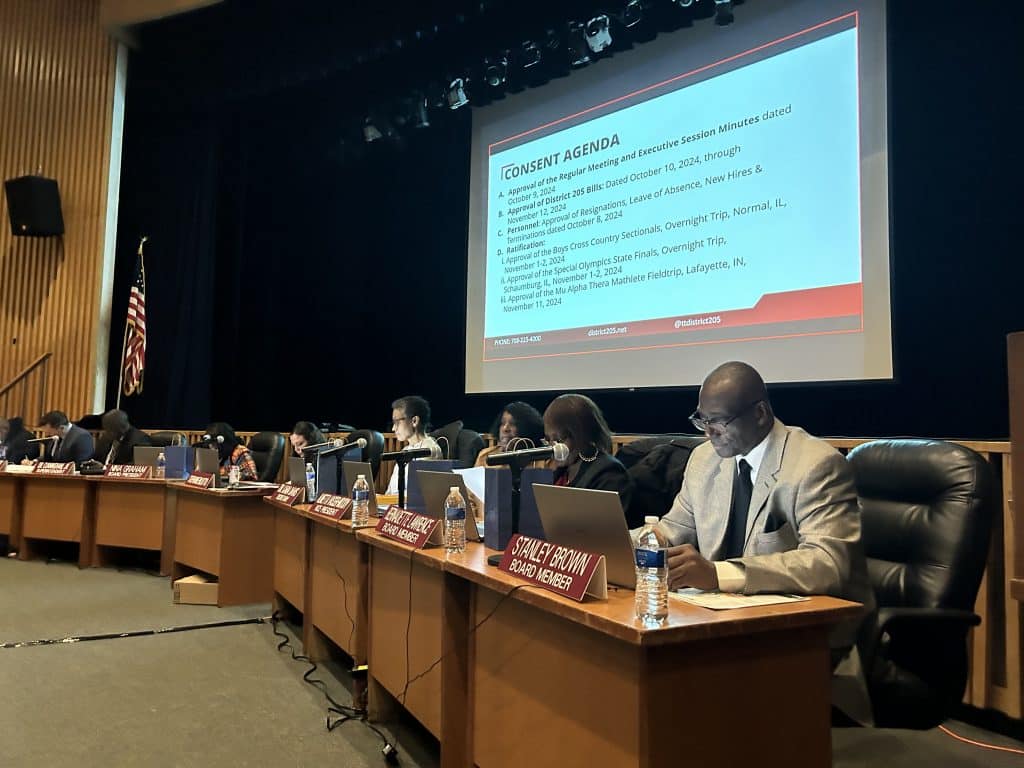

To further ensure transparency, the board unanimously approved the hiring of Doeren Mayhew, a certified public accountant firm, to conduct an audit of the district’s financial accounts.

AVID expands and excels

Coordinators with the Advancement Via Individual Determination (AVID) program have higher grade-point averages and passing rates, according to data shared by coordinators.

The AVID elective course emphasizes college readiness. Students are treated to weekly tutoring from college students. “Average students compared to last year’s data, 73 percent are passing all classes, compared to 52 percent and non-AVID students,” one coordinator shared. Additionally, AVID students boast an average GPA of 2.92, compared to 2.04 for their non-AVID peers, she added.

Thornton Township High School now offers 10 AVID sections serving 183 students. Thornridge High School has expanded to 11 sections with 227 students, an increase from six sections with 108 students participating. Thornwood High School has eight sections with 170 students participating.

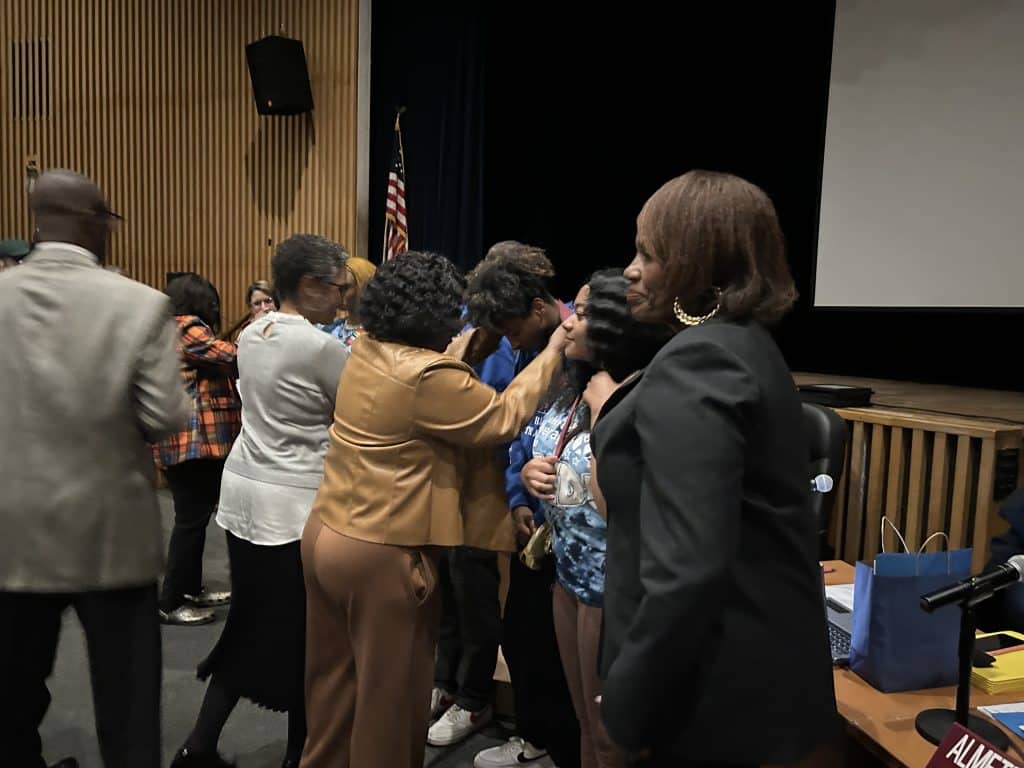

The program will collaborate with the Community Economic Development Association and UChicago Medicine Ingalls in January so last semester seniors can explore healthcare workforce development. The board celebrated these successes by awarding AVID students medals of distinction.

We’re filling the void after the collapse of local newspapers decades ago. But we can’t do it without reader support.

Help us continue to publish stories like these